25+ deduct mortgage interest

13 1987 your mortgage interest is fully tax deductible without limits. 30 x 12 360.

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Code Notes prev next a Allowance of credit 1 In general There shall be allowed as a credit against the tax.

. Web If your home was purchased before Dec. Just remember that under the 2018 tax. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Lock Your Rate Now With Rocket Mortgage. Lock Your Rate Now With Rocket Mortgage. Browse Information at NerdWallet.

Web The facts are the same as in Example 1 except that Bill used 25000 of the loan proceeds to substantially improve his home and 75000 to repay his existing mortgage. Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million.

Divide the cost of the points paid by the full term of the loan in. Take Advantage And Lock In A Great Rate. Ad Were Americas 1 Online Lender.

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web Basic income information including amounts of your income. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Also if your mortgage balance is. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web If you took out your mortgage on or before Oct. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web The interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more than. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe.

Ad Were Americas 1 Online Lender. Web Most homeowners can deduct all of their mortgage interest. Code 25 - Interest on certain home mortgages US.

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. If you are single or married and. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web 1 day agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web If youve closed on a mortgage on or after Jan.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Homeowners who are married but filing. Ad Learn More About Mortgage Preapproval.

Web 1 day agoMortgage interest and property taxes are two of the most well-known but you can also deduct any points you pay to acquire or refinance a mortgage. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Use NerdWallet Reviews To Research Lenders.

How Much Mortgage Interest Is Tax Deductible

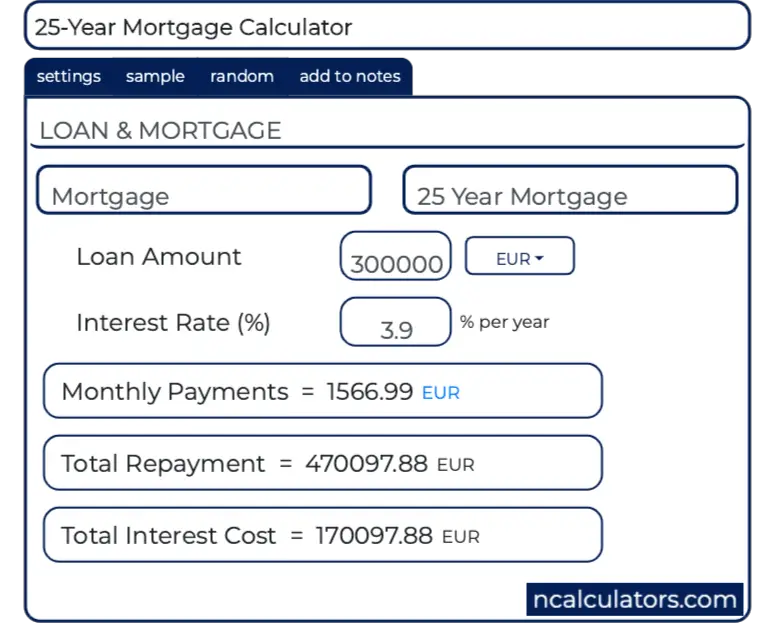

25 Year Mortgage Calculator

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Broker In Ontario Butler Mortgage

Keep The Mortgage For The Home Mortgage Interest Deduction

Has The Great Recession Raised U S Structural Unemployment In Imf Working Papers Volume 2011 Issue 105 2011

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

Selling Stock How Capital Gains Are Taxed The Motley Fool

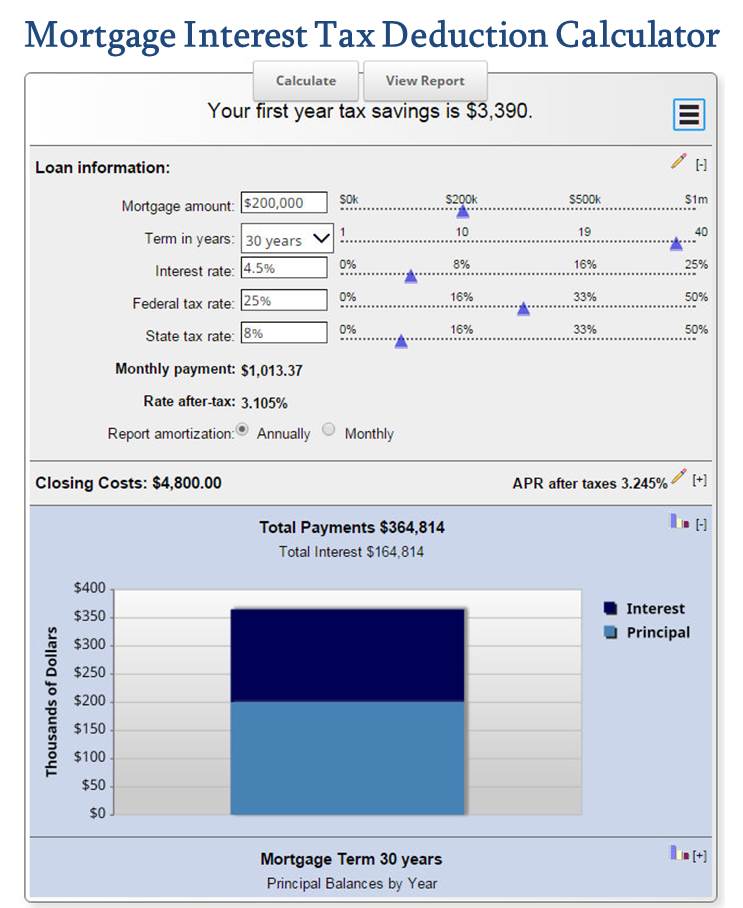

Home Mortgage Interest Deduction Calculator

Pace Financing For Solar Projects Lg Usa Business

Home Mortgage Interest Deduction Calculator

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Net Worth Stories Tenwilsons Twitter

Tax Loopholes Axiom Alpha